child tax credit monthly payments continue in 2022

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Thats because only half the money came via the monthly installments.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Here are the child tax benefit pay dates for 2022. During the second half of 2022 parents enjoyed monthly child tax credit payments.

If signed into law the White House says the bill would mean the 250 and 300 monthly payments would go out monthly in 2022. In 2022 the tax credit could be refundable up to 1500 a rise from 1400. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. If you have been receiving the child tax credit monthly payments since july you could be given up to 1800 for each child aged five and younger or up to 1500. In total itd cover 35 million householdsor.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Thats because only half the money came via the monthly installments.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Child Tax Credit 2022 These 14 States Offer Their Own Child Tax Credit

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

Enhanced Child Tax Credit To Continue For 1 More Year Per Democrats Plan

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit Will Monthly Payments Continue In 2022 Wfaa Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Parents Struggle After Monthly Child Tax Credit Payments End

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Will Child Tax Credit Payments Be Extended In 2022 Money

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

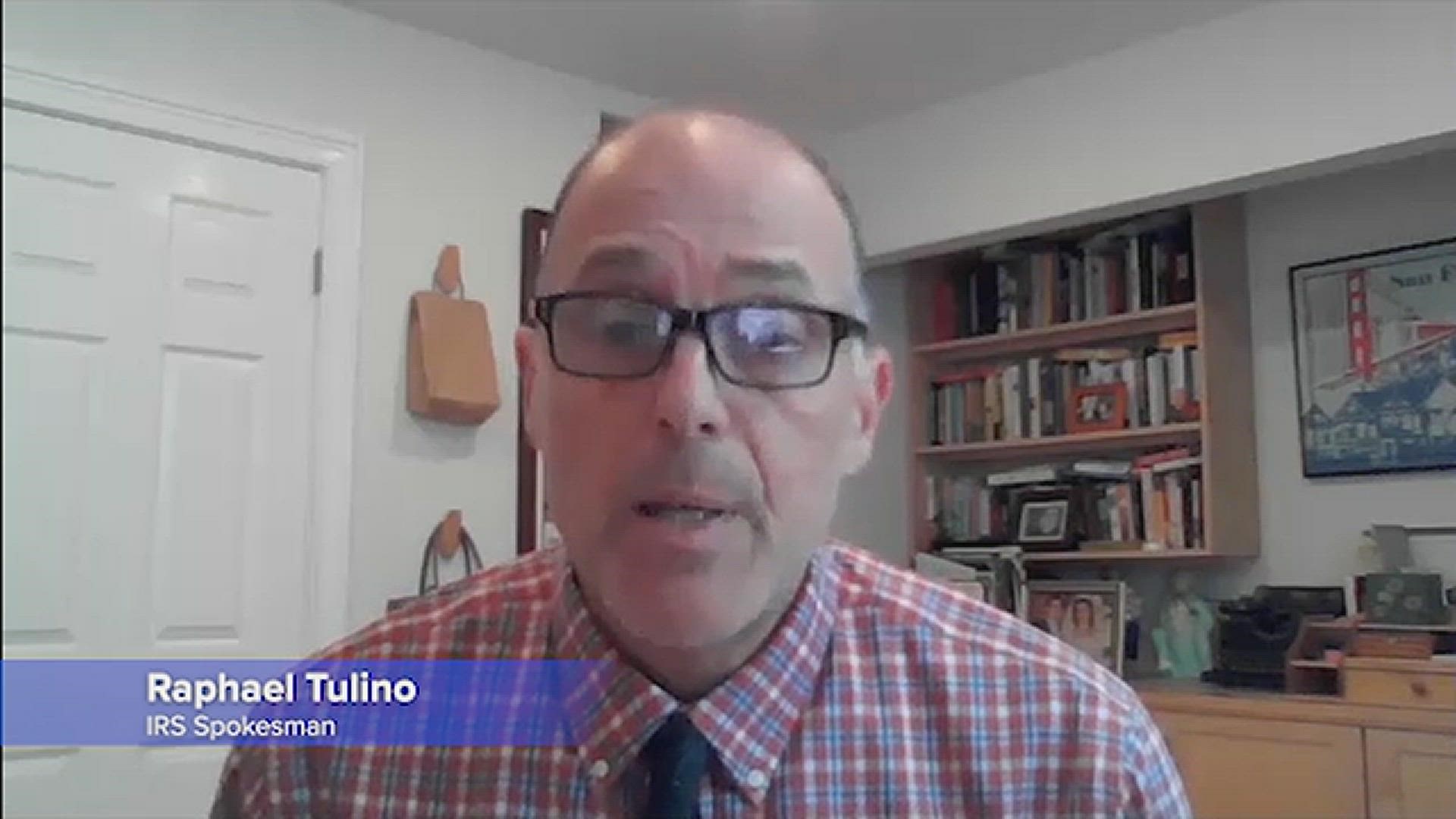

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Where Things Stand With The Monthly Child Tax Credit Payments Npr

Childctc The Child Tax Credit The White House

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr